Nfip Icc Brochure

Nfip Icc Brochure - National flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and renewed standard flood insurance policies. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. Increased cost of compliance (icc) is an endorsement of the flood insurance policy that provides a claim payment directly to a property owner for the cost to comply with state or community. If eligible, national flood insurance program (nfip) policyholders may receive up to $30,000 of increased cost of compliance (icc) coverage to help pay the costs to bring their building into. Increased cost of compliance (icc) coverage provides a claim payment, after a direct loss by flood, for the cost to comply with state or community floodplain management. (sfip) under the national flood insurance program (nfip) sustains a flood loss and the community declares the building to be substantially or repetitively damaged, icc. It provides up to $30,000 to. Claims for icc benefits are filed separately from your claim for contents or building. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. It provides general information about deductibles, what is covered or excluded by the national flood insurance program (nfip), and how items are valued at the time of loss. To help you cover the costs of meeting those requirements, the national flood insurance program offers increased cost of compliance (icc) coverage. Increased cost of compliance, or icc, coverage is part of most standard flood insurance policies. Increased cost of compliance (icc) coverage provides a claim payment, after a direct loss by flood, for the cost to comply with state or community floodplain management. It provides up to $30,000 to. If eligible, national flood insurance program (nfip) policyholders may receive up to $30,000 of increased cost of compliance (icc) coverage to help pay the costs to bring their building into. It provides up to $30,000 to help cover the cost of mitigation measures that will reduce flood risk. National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided that certain eligibility criteria are satisfied. (sfip) under the national flood insurance program (nfip) sustains a flood loss and the community declares the building to be substantially or repetitively damaged, icc. Icc coverage provides up to $30,000 of the cost to elevate, demolish,. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. It provides up to $30,000 to. If your building is insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip), increased cost of compliance (icc) coverage. Icc coverage provides up to $30,000 of the cost to elevate, demolish,. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. Icc coverage is a part of most standard flood insurance policies available under fema’s. It provides up to $30,000. Most nfip policies include increased cost of compliance (icc) coverage, which applies when food damage is severe. It provides up to $30,000 to help cover the cost of mitigation measures that will reduce flood risk. For more information about the. Fema and its national flood insurance program (nfip) have prepared this document to help you understand your standard flood insurance. Icc coverage is a part of most standard flood insurance policies available under fema’s. It provides general information about deductibles, what is covered or excluded by the national flood insurance program (nfip), and how items are valued at the time of loss. National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided. It provides general information about deductibles, what is covered or excluded by the national flood insurance program (nfip), and how items are valued at the time of loss. It provides up to $30,000 to help cover the cost of mitigation measures that will reduce flood risk. Icc coverage provides up to $30,000 of the cost to elevate, demolish,. To help. To help you cover the costs of meeting those requirements, the national flood insurance program offers increased cost of compliance (icc) coverage. National flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and renewed standard flood insurance policies. Icc coverage provides up to $30,000 of the cost to elevate, demolish,. Most nfip policies include increased. (sfip) under the national flood insurance program (nfip) sustains a flood loss and the community declares the building to be substantially or repetitively damaged, icc. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. If eligible, national flood insurance program. Increased cost of compliance, or icc, coverage is part of most standard flood insurance policies. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. Icc coverage is a part of most standard flood insurance policies available under fema’s. Claims for icc benefits are filed separately from. Most nfip policies include increased cost of compliance (icc) coverage, which applies when food damage is severe. Increased cost of compliance (icc) is an endorsement of the flood insurance policy that provides a claim payment directly to a property owner for the cost to comply with state or community. Increased cost of compliance, or icc, coverage is part of most. (sfip) under the national flood insurance program (nfip) sustains a flood loss and the community declares the building to be substantially or repetitively damaged, icc. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. Increased cost of compliance (icc) is an endorsement of the flood insurance. Icc coverage provides up to $30,000 of the cost to elevate, demolish,. (sfip) under the national flood insurance program (nfip) sustains a flood loss and the community declares the building to be substantially or repetitively damaged, icc. Fema and its national flood insurance program (nfip) have prepared this document to help you understand your standard flood insurance policy (sfip). Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. It provides up to $30,000 to help cover the cost of mitigation measures that will reduce flood risk. Most nfip policies include increased cost of compliance (icc) coverage, which may apply to an insured building when flood damage is substantial. Increased cost of compliance (icc) is an endorsement of the flood insurance policy that provides a claim payment directly to a property owner for the cost to comply with state or community. If your building is insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip), increased cost of compliance (icc) coverage will help cover. Increased cost of compliance, or icc, coverage is part of most standard flood insurance policies. National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided that certain eligibility criteria are satisfied. It provides up to $30,000 to. National flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and renewed standard flood insurance policies. You must have building coverage to qualify. It provides general information about deductibles, what is covered or excluded by the national flood insurance program (nfip), and how items are valued at the time of loss. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. Most nfip policies include increased cost of compliance (icc) coverage, which applies when food damage is severe. NFIP Publications Order Form

2023 NFIP Claims Adjuster Manual FEMA's National Flood Insurance

Moving Beyond the Essentials Page 3 of 5 Flood Science Center

NFIP Brochure Refresh

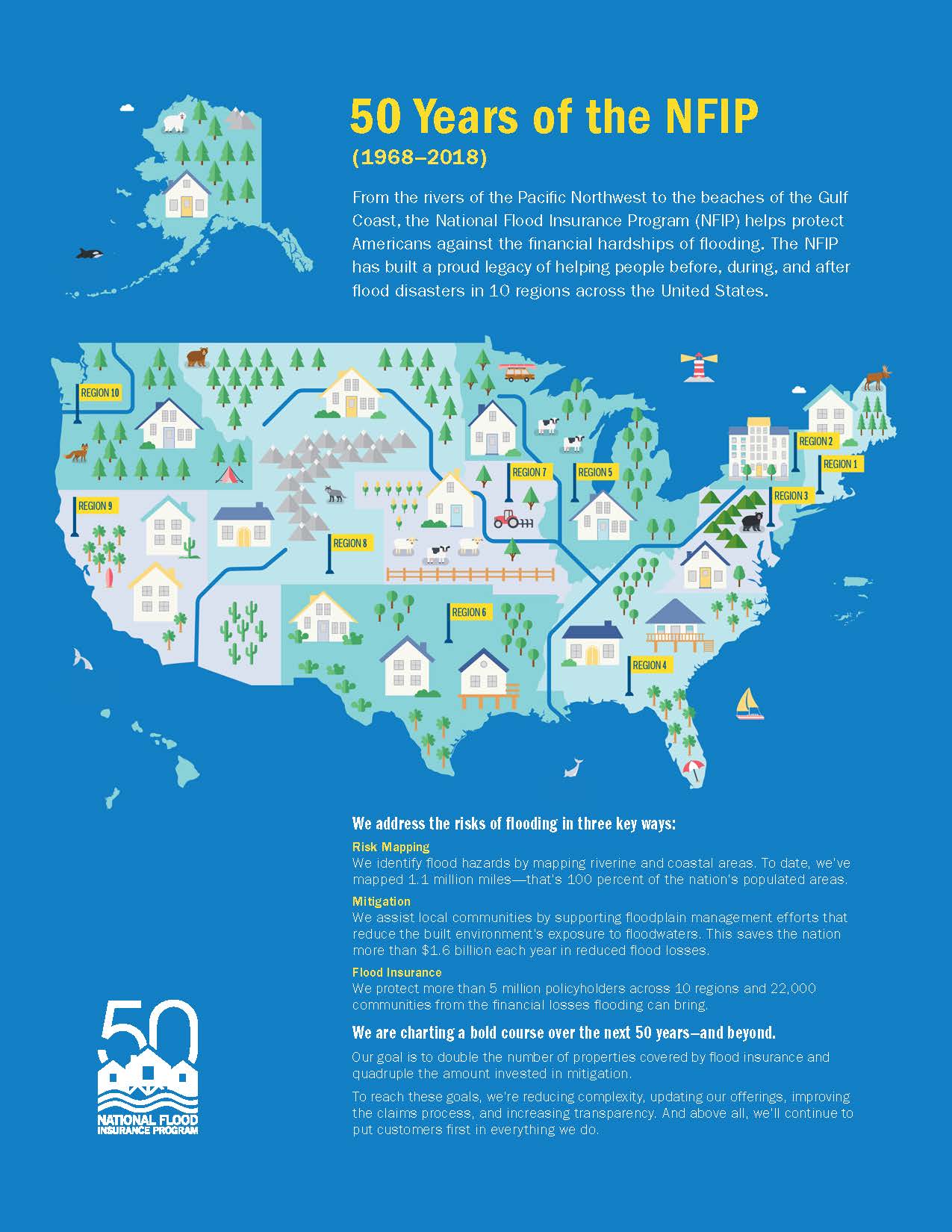

Individuals Floodplain Management Resources FEMA.gov

NFIP Brochure Refresh

(PDF) Comparison of Select NFIP and Building Code Requirements

National Flood Insurance Program Info North Franklin Township

Digital Partnerships Orchid Insurance

(PDF) I. NFIP ELEVATION CERTIFICATEI. NFIP ELEVATION CERTIFICATE The

To Help You Cover The Costs Of Meeting Those Requirements, The National Flood Insurance Program (Nfip) Includes Increased Cost Of Compliance (Icc) Coverage For All New And.

Claims For Icc Benefits Are Filed Separately From Your Claim For Contents Or Building.

For More Information About The.

If Eligible, National Flood Insurance Program (Nfip) Policyholders May Receive Up To $30,000 Of Increased Cost Of Compliance (Icc) Coverage To Help Pay The Costs To Bring Their Building Into.

Related Post: