Fdic Brochure

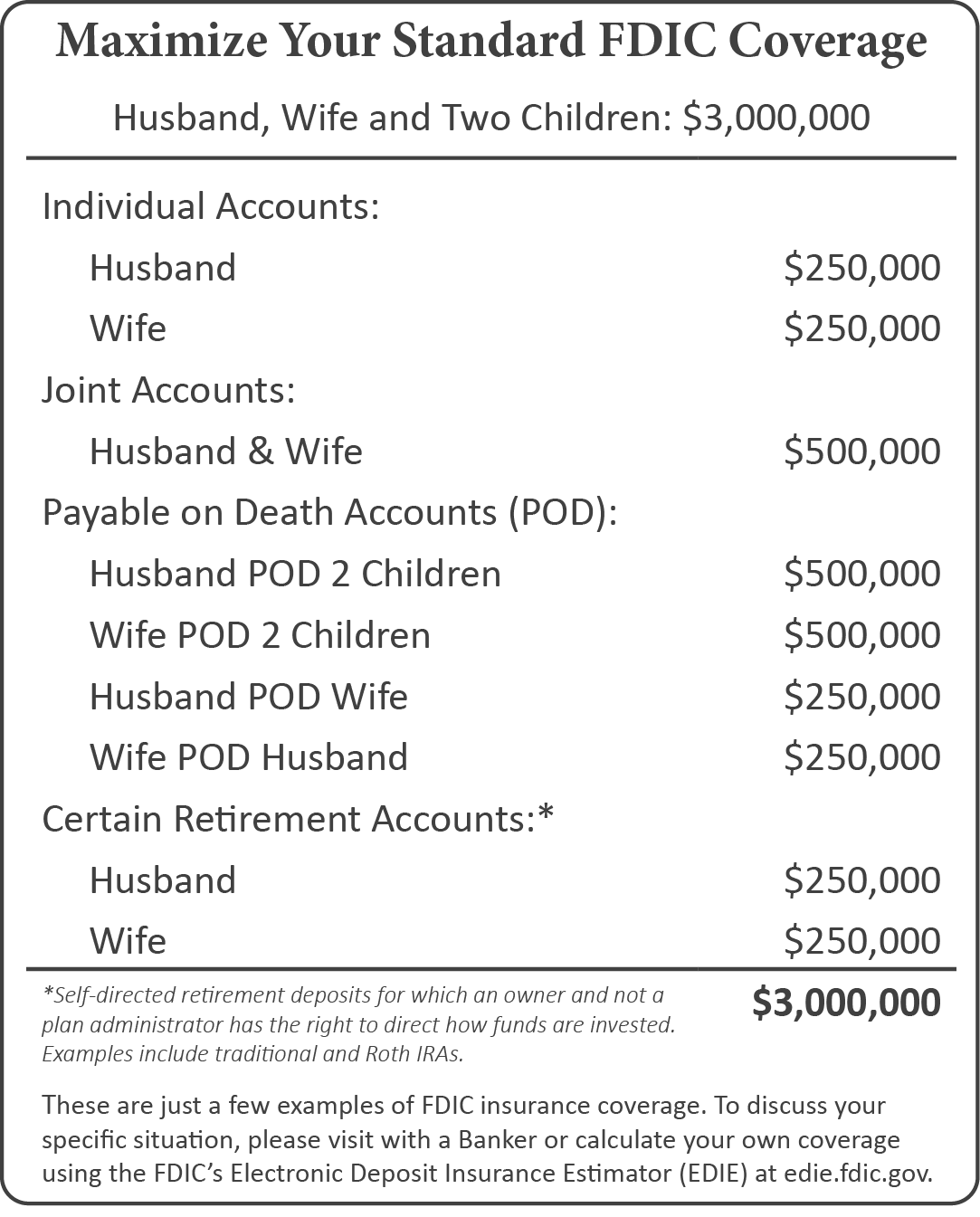

Fdic Brochure - Deposit insurance coverage for the most common account ownership categories. This brochure provides basic information about the types of accounts that are insured, coverage limits, and how the fdic insures your money if your bank fails. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. To check whether the fdic insures a specific. Designed to address the most common account ownership. Fdic insurance is backed by the full faith and credit of the united states government. Since the fdic was founded in 1933, no depositor has. Fdic deposit insurance is backed by the full faith and credit of the united states government. The fdic protects you against the loss of your deposits if an fdic. The fdic protects you against the loss of your deposits if an fdic. The recently revised brochure contains answers to the latest changes in deposit insurance regulations, including questions about insurance coverage following death of an. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. Fdic insurance is backed by the full faith and credit of the united states government. Provide your clients with essential information on fdic deposit insurance coverage using this detailed and updated brochure. The fdic has developed two new resources to help bank employees and depositors understand fdic deposit insurance coverage: Since the fdic was founded in 1933, no depositor has. Fdic deposit insurance is backed by the full faith and credit of the united states government. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. The fdic has developed two new resources to help bank employees and depositors understand fdic deposit insurance coverage: Fdic insurance is backed by the full faith and credit of the united states government. For simplicity, this brochure uses the. Deposit insurance coverage for the most common account ownership categories. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. The fdic has developed two new resources to help bank employees and depositors understand fdic deposit insurance coverage: The fdic protects you against the loss of your deposits if an fdic. The recently revised brochure contains. Deposit insurance coverage for the most common account ownership categories. This brochure provides basic information about the types of accounts that are insured, coverage limits, and how the fdic insures your money if your bank fails. The recently revised brochure contains answers to the latest changes in deposit insurance regulations, including questions about insurance coverage following death of an. Banking. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. Fdic insurance is. Fdic insurance is backed by the full faith and credit of the united states government. This brochure provides basic information about the types of accounts that are insured, coverage limits, and how the fdic insures your money if your bank fails. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured. Deposit insurance coverage for the most common account ownership categories. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. Provide your clients with essential information on fdic deposit insurance coverage using this detailed and updated brochure. This deposit insurance brochure is a comprehensive description of fdic deposit insurance coverage for the most common account ownership. Fdic deposit insurance is backed by the full faith and credit of the united states government. To check whether the fdic insures a specific. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. Provide your clients with essential information on fdic deposit insurance coverage using this detailed. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. Provide your clients with essential information on fdic deposit insurance coverage using this detailed and updated brochure. Designed to address the most common account ownership. This brochure is not intended as a legal interpretation of the fdic’s laws. Deposit insurance coverage for the most common account ownership categories. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Fdic insurance is backed by the full faith and credit of the united states government. This deposit insurance brochure is a comprehensive description of fdic deposit insurance coverage for. The fdic has developed two new resources to help bank employees and depositors understand fdic deposit insurance coverage: This deposit insurance brochure is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. Since the fdic was founded in 1933, no depositor has. This brochure is not intended as a legal interpretation of the fdic’s. The fdic protects you against the loss of your deposits if an fdic. For simplicity, this brochure uses the term “insured bank” to mean any bank or savings association that is insured by the fdic. This brochure is not intended as a legal interpretation of the fdic’s laws and regulations. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. The recently revised brochure contains answers to the latest changes in deposit insurance regulations, including questions about insurance coverage following death of an. The fdic has developed two new resources to help bank employees and depositors understand fdic deposit insurance coverage: Provide your clients with essential information on fdic deposit insurance coverage using this detailed and updated brochure. Deposit insurance coverage for the most common account ownership categories. To check whether the fdic insures a specific bank or. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. To check whether the fdic insures a specific. Banking industry research, including quarterly banking profiles, working papers, and state banking performance data. This deposit insurance brochure is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. Fdic deposit insurance is backed by the full faith and credit of the united states government. Since the fdic was founded in 1933, no depositor has.FDIC Booklet

FDIC JOINT & POD 4/Panel Brochure Folded Updated 250K Insurance Pack

FDIC Deposit Insurance Brochure 4 Panel Folded

Fdic 2024 Brochure Elga Nickie

Equal Housing FDIC Brochure Wolters Kluwer

Reprintable FDIC Brochures FDIC.gov

FDIC Deposit Insurance Brochure 4 Panel Folded

FDIC JOINT & POD Brochure Folded Updated 250K Insurance

FDIC Deposit Insurance at a Glance Brochure by Traditions Bank Issuu

Fdic 2024 Brochure Meaning Esta Alexandra

This Brochure Provides Basic Information About The Types Of Accounts That Are Insured, Coverage Limits, And How The Fdic Insures Your Money If Your Bank Fails.

For Simplicity, This Brochure Uses The Term “Insured Bank” To Mean Any Bank Or Savings Association That Is Insured By The Fdic.

Designed To Address The Most Common Account Ownership.

Fdic Insurance Is Backed By The Full Faith And Credit Of The United States Government.

Related Post: